In a world characterized by strict regulations, changing customer-needs based on generational differences, and unprecedented competition, what gives the banking industry the fuel to go that extra mile ahead?

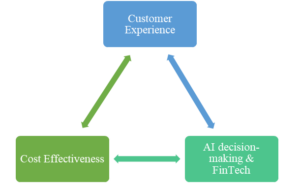

Customer experience, cost-effectiveness, and AI decision-making, and fintech are the three areas that ensure the success of banks. Attaching these feathers to a company’s cap requires the effective integration of lean management, six sigma, and kaizen. Success today should not compromise progress every day. This ensures constant and real-time adaptation to the latest features in the field of operational excellence, thereby never falling behind in the race.

Customer experience, cost-effectiveness, and AI decision-making, and fintech are the three areas that ensure the success of banks. Attaching these feathers to a company’s cap requires the effective integration of lean management, six sigma, and kaizen. Success today should not compromise progress every day. This ensures constant and real-time adaptation to the latest features in the field of operational excellence, thereby never falling behind in the race.

“Perfection is not attainable. But if we chase perfection, we can catch excellence.”

Why Operational Excellence?

Lean Management

The collapse of 2008 was a global financial crisis triggered by excessive risk-taking by banks and unprecedently low-interest rates which led to the formation of the “housing bubble”, predominantly in the U.S. Credits were expanded to the extent that they propelled the market artificially beyond its limits. This overproduction led to the piling-up of unusable values, and manifested in banks’ inventory wastes, as the value of banks’ total raw material and capital sunk. Eventually, the biggest and most reputable bank in Wall street, the Lehman Brothers, collapsed.

To avoid a scenario like this, lean management implements the customer’s perspective, thereby eliminating management efforts and processes which are not in line with a customer’s values. Cost-to-value analyses are done, and operations are standardized – resulting in zero-waste. This zero-waste strategy is typically used by banks to eliminate costs and effort in the following areas:

Overproduction: It refers to a service or product generation in the banking industry that supersedes its demand, thereby leading to stock-piling of unusable and value-less capital.

Motion waste: These are wastes associated with inefficient banking operations, such as excessive waiting-time faced by customers.

Motion waste: These are wastes associated with inefficient banking operations, such as excessive waiting-time faced by customers.

Inventory waste: It refers to the waste of capital in stock within banks.

Defects: It is the waste produced when banks sell products that customers do not prioritize. Lean management regulates this by implementing quality controls.

Lean management ensures that financial goals and management processes are in sync with clients, employees, and managers – and so the net result culminates to reduced employee-turnover, a decrease in operating expenses, and a hike in customer satisfaction. In banking, lean implements minimal investment with lasting results.

For processes such as credit card applications, lean management ensures a more user-friendly approach along with effective outcomes. Furthermore, with the increasing number of regulatory restrictions on bank procedurals, lean is invaluable in terms of avoiding largescale waste production and inaccurate risk-management – hence reducing effort and costs and creating new areas of improvement.

Six Sigma

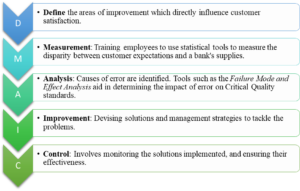

In the banking sector, six sigma is used as a process change, which aims to increase profitability by reducing product defects – thus, enhancing a bank’s operations-quality and customer satisfaction. It utilizes statistical measures to analyze a particular organizational problem, and devises strategies accordingly using the DMAIC process:

Six sigma helps in improving loan processes, retail banking services, opening accounts, etc., by reducing the net cycle time invested in each service. Customer satisfaction is greatly affected by customer-waiting time and service delivery, and operational excellence addresses these areas.

Six sigma helps in improving loan processes, retail banking services, opening accounts, etc., by reducing the net cycle time invested in each service. Customer satisfaction is greatly affected by customer-waiting time and service delivery, and operational excellence addresses these areas.

Kaizen

Kaizen is a method of ‘continuous improvement’ that circles around teamwork, discipline, heightened morale, and improvement strategies, via implementing streamlined changes. It is an organizational revolution that focuses on bottom-up improvement within a bank, which will increase its competitiveness – thereby enhancing employee-engagement. This will have a direct impact on their interactions with customers, hence also influencing the latter’s satisfaction level.

The Wave of Change

With only IT services, it is possible to survive the competition within the banking industry. To be ahead of it, you need to integrate the latest trends of operational excellence and align your company with a vision that does not just guarantee success today but ensures adaptability and progress every day.

Digitization

A user-friendly digital banking experience is the first and foremost measure that banks need to incorporate – especially mobile banking. Alongside providing a larger customer-base, services such as one-click payments, recurrent deposits, international fund transfers, opening fixed deposits, etc., are made so much easier with mobile banking. With data analytics, six sigma, and lean implementation, customer-needs can be identified, and corresponding mobile-experiences could be developed at a cheaper rate than what traditional banking procedures would have required. These provide a leveled competing ground for banks to accelerate their growth against those of ‘BigTech‘ companies like Apple and Google, who are now releasing their FinTech services. Hence, constant integration of cloud computing features and digital processes will increase a bank’s need for fulfilling predicted revenue growth and risk-assessment, thereby securing their lead and dominance in the finance company against its competitors.

A user-friendly digital banking experience is the first and foremost measure that banks need to incorporate – especially mobile banking. Alongside providing a larger customer-base, services such as one-click payments, recurrent deposits, international fund transfers, opening fixed deposits, etc., are made so much easier with mobile banking. With data analytics, six sigma, and lean implementation, customer-needs can be identified, and corresponding mobile-experiences could be developed at a cheaper rate than what traditional banking procedures would have required. These provide a leveled competing ground for banks to accelerate their growth against those of ‘BigTech‘ companies like Apple and Google, who are now releasing their FinTech services. Hence, constant integration of cloud computing features and digital processes will increase a bank’s need for fulfilling predicted revenue growth and risk-assessment, thereby securing their lead and dominance in the finance company against its competitors.

The Dawn of AI and Robotics

“What is the bank doing with my money?“

This is an age-old question that users still do not have a concrete answer to, and it is the sole reason why they do not trust banks to work in their best interest. It accounts for a staggeringly low 28% of millennials and Gen Z’s to trust their bank to be fair and honest. They would rather not invest in traditional banking services because they seem outdated – and this is what needs to change if a wider customer-base is to be established within the next few years.

“A lack of transparency results in distrust and a deep sense of insecurity”

– Dalai Lama

To tackle this, artificial intelligence provides the most appropriate solution for banks. Via automating core banking processes and simplifying them into comprehensible information for clients to process, AI transformation helps in increasing transparency between banks and their clients. This is done by analyzing a customer’s financial records, daily expenses, investment patterns, and personal monetary habits and provide a customer with objective analytics of possible ventures regarding what they should do with their money. The degree of honesty and objectivity provided by a bank is what will set it apart from others – and it will either make or break its reputation.

To tackle this, artificial intelligence provides the most appropriate solution for banks. Via automating core banking processes and simplifying them into comprehensible information for clients to process, AI transformation helps in increasing transparency between banks and their clients. This is done by analyzing a customer’s financial records, daily expenses, investment patterns, and personal monetary habits and provide a customer with objective analytics of possible ventures regarding what they should do with their money. The degree of honesty and objectivity provided by a bank is what will set it apart from others – and it will either make or break its reputation.

“Our industry is one in which the services of the leading investment bankers are all pretty much the same. So, I’ve always believed that one’s reputation is extremely important and that decisions are often made according to the general reputation a firm has…”

– John Whitehead (former chairman of Goldman Sachs)

Alongside these, AI integration will engender significantly faster decision-making based on real-time data in areas with a high degree of customer transactions (such as auto-financing and retail loans). It also incorporates the usage of Robotic Process Automation (RPA). It essentially automates human activities in banking, thereby replacing manual data entry, etc. This saves invaluable time, costs, and effort – thereby increasing customer satisfaction. They save money on human capital, reduce the likelihood of fraud and human errors.

FinTech

FinTech, i.e. financial technology, can help in tracing funds, trading stocks, making monthly payments, etc., and it transforms the way users manage their finances. They provide a fast and secure service, and therefore have gained popularity among the latest generations – and in a sense, FinTech provides competition to traditional banking sectors by providing services like smart chip technology, and customer service chatbots.

Fintech is also used to increase security measures for digital banking, with less effort required from customers, Biometric sensors and iris scanners are two such technologies that eliminate the need for remembering passwords, while also providing a higher degree of security.

Fintech is also used to increase security measures for digital banking, with less effort required from customers, Biometric sensors and iris scanners are two such technologies that eliminate the need for remembering passwords, while also providing a higher degree of security.

How can banks compete with it?

The answer is – they do not have to. They simply need to integrate FinTech into their services and collaborate with them in the areas they are needed in.

“Fin-Tech and banks need a cultural reconciliation: risk appetite and tolerate trial and errors”

FinTech is an integral part of modern-day banking, as they account for a large portion of their digital plans. It incorporates a fresh perspective into managing customer finances, by providing streamlined digital experiences, being customer-centric right from the beginning and prioritizing 24/7 access to services, and establishing cost-effectiveness. However, FinTechs often lack banking licenses and do not have the same profits and customer-base that banks do. Therefore, a collaboration between the two would be mutually beneficial, whereby FinTechs would gain validity and stability, and banks would inherit their customer-transparency.

The Road Ahead

Banks and their services will gain momentum only if they effectively implement the latest operational excellence trends. Revenues and profit margins will increase, automated services will save time, effort, and money, and lean management will eliminate all waste-production. Banking as we know it will remain a significantly necessary service for the foreseeable future.

The key to unlocking this future is for banks to build customer satisfaction and transparency. They need to garner trust from millennials and Gen Z – their new clientele. Without a substantial demand, increasing the quantity and quality of supplies will not matter – and eventually, another market glut is bound to be triggered.

“The inescapable truth is that there are just too many banks in this country chasing too few customers.“

– Dick Rosenberg (former CEO of Bank of America)